net operating working capital turnover

Working capital or net current assets An accounting term denoting a firms short-term CURRENT ASSETS which are turned over fairly quickly in the course of business. Capital turnover is the measure that indicates organizations efficiency in relation to the utilization of capital employed in the business and it is calculated as a ratio of total annual turnover divided by the total amount of stockholders equity also known as net worth and the higher the ratio the better is the utilization of capital employed.

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working C Management Capital Finance What Is Work

Net Operating Income Approach to capital structure believes that the value of a firm is not affected by the change of debt component in the capital structure.

. This ratio indicates the liquidity of your business. It is defined as current assets less current liabilities and in exam questions the components are usually inventory and trade receivables trade payables and bank overdraft. Working capital represents the net current assets available for day-to-day operating activities.

Working capital is a very important concept and it helps us to understand the companys current position. It is calculated by dividing the current assets of your business with its current liabilities. Current assets refer to those assets which in the ordinary course of business can be or will be converted into cash.

However if the change in NWC is negative the business model of the company might require spending cash before it can sell. They include raw materials work in progress and finished goods STOCKS DEBTORS and cash less short-term CURRENT LIABILITIESFig. This means that the liquidity position of the company is better off in 2018 than in 2017.

Below is the given data Calculation of Operating Working Capital 150000-80000. Calculate Days and Net Operating Working Capital. This ratio is also called the current ratio.

Net- working capital and working capital gap for assessment of working capital limits for a company. Operating Working Capital 70000. What is Working Capital.

This implies that the company has its cash locked in for a period of 127 days and would need funding from some source to let the operations continue as creditors need to be paid off in 30 days. Net Current Assets as percentage of Total Assets. Net Working Capital 2017 Total Current Assets Total Current Liabilities.

The term working capital means sum of the funds invested at various current assets used in the operating cycle by. It assumes that the benefit that a firm derives by infusion of debt is negated by the simultaneous increase in the required rate of return by the equity shareholdersWith an increase in debt the risk associated. If the change in NWC is positive the company collects and holds onto cash earlier.

Selling general administrative or SGA OPERATING INCOME Depreciation amortization OPERATING INCOME Interest expense Other non-operating expensesincome Income taxes Extraordinary items NET INCOME EBITDA EBIT Jarrod Goentzel Working capital Working capital is required to. Cash Flow Per Share. Here in the above example as we can see the Days working Capital is 126 days and that.

Banks in India have evolved their own method of lending as they have been given free hand by the Central Bank that is RBI to decide the lending methods. Current liabilities are best paid with current assets like cash cash equivalents and. Assuming the company had to make all cash.

The working capital ratio is important to creditors because it shows the liquidity of the company. Long Term Debt to Equity. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period.

Net Working Capital Ratio refers to a ratio that includes all the components of your Net Working Capital. Total Assets Per Share. Operate the business serve the.

Net Working Capital 2017 85562 98255. Working capital management 1. Nature of Working Capital Working capital management is concerned with the problems that arise in attempting to manage the current assets the current liabilities and the interrelations that exist between them.

90 shows the major components of the working capital cycle. Cash and Equivalents Turnover. Working capital turnover is a ratio that measures how efficiently a company is using its working capital to support sales and growth.

Change in Net Working Capital 6710000 2314000. Also known as net sales to. Working Capital Cycle Inventory turnover in days debtors turnover in days creditors turnover 102 55 -30 127 days.

What Is Working Capital Turnover. That is whether you have sufficient funds to run your business operations in the short-term. Calculation of Days Working Capital is as follows 70000360200000 126 days.

The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets. How Working Capital Turnover Works Working capital turnover is a ratio comparing the depletion of working capital to the generation of sales over a given period. Change in Net Working Capital 4396000 Explanation.

The Net working capital of Colgate Palmolive India had increased from -12693 Cr in 2017 to 7793 Cr in 2018. Net Working Capital 2017 -12693 Cr.

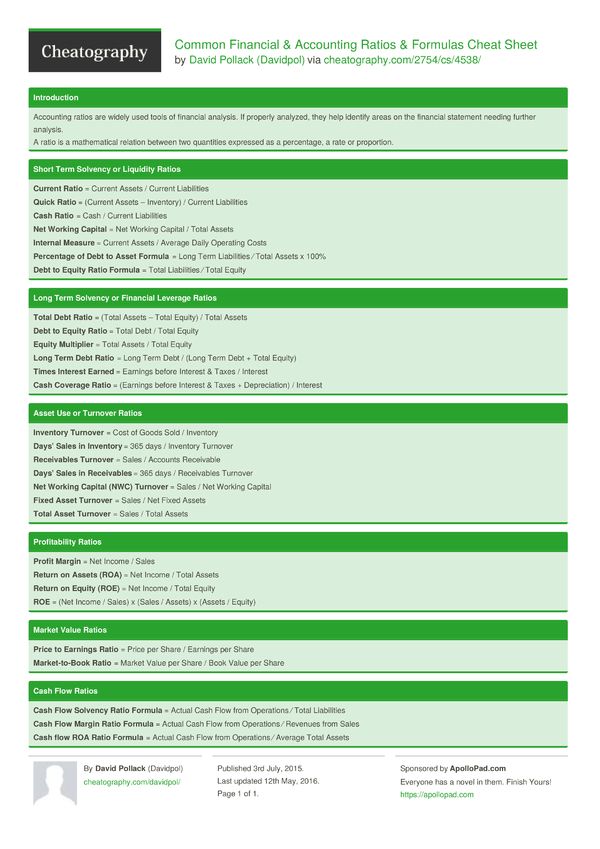

Common Financial Accounting Ratios Formulas Financial Accounting Financial Analysis Accounting

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working Cap Capital Finance Management It Network

Advantages And Disadvantages Of Cash Credit Cash Credit Accounting And Finance Financial Management

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working Cap Management Capital Finance It Network

Common Financial Accounting Ratios Formulas Cheat Sheet From Davidpol Financial Accounting Accounting Cost Accounting

Net Debt What It Is How To Calculate It And What It Tells Bookkeeping Business Financial Literacy Lessons Accounting And Finance

Key Financial Ratios Financial Ratio Company Financials Financial Analysis

The Kpi Compendium 20 000 Key Performance Indicators Used In Practice Key Performance Indicators Kpi Finance Function

Types Of Cash Flow Cash Flow Statement Learn Accounting Finance Investing